Abstract

This study introduces a new version of the adjusted present value (APV) method and ensures its consistent valuation with the cost of capital (CoC) method at the highest level of generalization. The newly developed APV version and equivalent formulae consider stochastic debt and the trade-off between corporate income taxes (CIT) and personal income taxes (PIT), as well as tax benefits and financial distress costs. The value of expected bankruptcy costs aligns with the valuation aspect, enabling practical application of the formulae by valuers. The equivalence also reflects the differing perspectives of tax shields between stockholders and debt holders when PITs are introduced. Ultimately, the results demonstrate that the equivalence in this study aligns with, and can reduce to, previous standard formulae, under their stringent assumptions.

Similar content being viewed by others

Notes

Therefore, the CoC method is also known as the weighted average cost of capital (WACC) method, the adjusted discount rate (ADR) method, or the free cash flow to the firm (FCFF) method (see, e.g., Taggart 1991).

The term “costs of financial distress” may be more appropriate than “bankruptcy costs” (see Ross et al. 2013). In this paper, we use these two terms interchangeably, assuming they convey the same meaning.

Under international valuation standards (IVSs), there are three approaches in the application for valuing a business, including market-based, cost-based, and income-based approaches (IVSC 2021). Each of these approaches includes different valuation methods of application. The income-based approach is the most popular approach for most valuation purposes, for example, M&A and IPO (see Damodaran 2012; Koziol 2014). A survey by Ross (2006) reveals that 29.1% of respondents typically prefer a DCF valuation as their first choice. Similarly, a valuation methodology survey in Africa reported by PwC (2017), indicates that 64% of respondents primarily use the income-based approach for their valuations. The dividend discount (DDM), flows-to-equity (FTE), capital cash flow (CCF), cost of capital (CoC), and adjusted present value (APV) methods are five well-known models within the income-based approach to value a business. The first two methods directly estimate equity value, whereas the others calculate the firm value directly.

From a valuer perspective, the CoC and APV methods are more frequently used in practice than other methods to ensure cross-checking and to minimize valuation errors. Ross (2006) also shows that 63% of respondents typically or almost always use the CoC method, while the APV method proves most useful in complex valuation situations.

Altman of NYU’s Stern School of Business estimates the risk probability of default as part of an annual series (see Damodaran 2012).

RICS (2021) is effective from January, 31 2022. RICS (Royal Institution of Chartered Surveyors) is an internationally acknowledged professional organization that promotes and enforces the highest professional standards in develo**, managing, and valuing land, real estate, construction, infrastructure, projects, businesses, and intangible assets.

Effective from January 31, 2022.

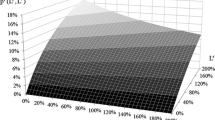

These works have significantly influenced the new era of finance and valuation literature. Modigliani and Miller (1958) argue that optimal capital structures do not exist, and there is no difference in value between a levered and an unlevered company in complete and perfect capital markets. When CITs are introduced, but PITs are still assumed to be equal zero, the value of tax shields becomes positive. This increase leads to the value of levered firms being higher than that of unlevered firms, due to the contribution of tax savings (Modigliani and Miller 1963). However, there are certain implications when analyzing the 1963 MM theory: (i) the model only considers tax shields with a zero risk of financial distress, leading to maximum firm value when corporations finance with 100% debt, (ii) a linear relationship exists between capital structure and firm value because of the positive value of tax shields, and (iii) the model does not account for PITs, which may distort the present value of tax shields due to dividends paid from earnings after taxes.

Several factors identified in this literature have influenced contemporary capital structure theories. These include the PIT (Miller 1977), the trade-off theory's costs of financial distress (Kraus and Litzenberger 1973; Scott 1976), agency costs with the agency theory (Jensen and Meckling 1976; Myers 1977), and the pecking-order theory's timing (Myers 1984).

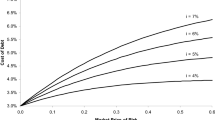

For example, Sharpe (1964) and Lintner (1965) introduce the capital asset pricing model (CAPM) for calculating the discount rate (i.e., the cost of capital) based on the portfolio theory of Markowitz (1952). Myers (1974) develops the APV method based on the idea of tax shields of Modigliani and Miller (1963). Later studies have attempted to provide consistent valuation between the CoC and APV methods (e.g., Sick 1990; Taggart 1991; Schultze 2004; Dempsey 2013; Cooper and Nyborg 2018; Kolari 2018).

The firm value in the valuation report is the sum of three components: (i) \(V^{A\ell }_t\); (ii) the value of operating assets that creates cash flows, but these cash flows have not yet been estimated in the FCFF (i.e., \(V^{A\ell }_t\)); and (iii) the value of non-operating assets. Some researchers and practitioners in valuation regard the last two components as the value of non-operating assets. Most valuation textbooks focus on \(V^{A\ell }_t\) for the income-based approach. Indeed, when applying the DCF technique-based valuation, valuers take more time to estimate the first component. Therefore, we concentrate solely on valuation models to estimate \(V^{A\ell }_t\). However, we note that these three components are independent, primarily because of the summation calculator. This implies that all items used to estimate \(V^{A\ell }_t\) (e.g., earnings, cash flows, assets, reinvestment) must be independent and not related to any items in the remaining components, such as the current financial investment, to prevent overlap in the estimation.

There are three main arguments related to the period between cash flows and discount rates. The first is the same period for both FCFF and \(\kappa\), that is, \(FCFF_i\) is discounted at \(\kappa _i\) (e.g., Miles and Ezzell 1980). The second is that \(\kappa\) lags one period behind cash flows, that is, \(\kappa _i\) is used to discount \(FCFF_{i+1}\) (e.g.,Kruschwitz and Löffler 2006; Husmann et al. 2006; Bade 2009; Dempsey 2019). The third is the constant cost of capital, i.e., \(\kappa _i=\kappa\) (e.g., Molnár and Nyborg 2013; Damodaran 2012; Pinto et al. 2015; Cooper and Nyborg 2018). Because there is no significant difference between these approaches, for simplicity, we apply the third option. The results are not affected by this assumption. We can replace \((1+\kappa )^{i}\) for the third idea with \(\prod \limits _{j=t+1}^{t+i}(1+\kappa _j)\) for the first idea or \(\prod \limits _{j=t+0}^{t+i-1}(1+\kappa _j)\) for the second idea, whenever needed.

The debt concept in this study includes debt and debt-like liabilities.

Eq. (2) is the standard equation referred to as the textbook WACC under the assumption of risk-free debt (Dempsey 2013). Some studies provide discount rate formulae under the alternative condition of risky debt (e.g., Miles and Ezzell 1980; Taggart 1991; Cooper and Nyborg 2008). However, Cooper and Nyborg (2008) argue that the textbook WACC assumption leads only to minor errors, in general.

This method's results are also used to cross-verify those from other methods in the income-based approach.

Note that while bankruptcy costs decrease firm value, the firm's value may continue to decline even without VEBC, owing to factors such as lawyers' advisory fees. Consequently, financial distress costs might be a more accurate concept than bankruptcy costs (Ross et al. 2013). However, our study focuses on valuation and anticipates the application of valuation models in the real world. Therefore, we use the term “bankruptcy costs” because of the substantial empirical evidence related to this cost.

Numerous subsequent studies introduce various costs to balance in a cost-benefit analysis related to debt, such as the agency cost presented in the agency theory developed by Jensen and Meckling (1976).

The notations above are similar to that of Kim-Duc and Nam (2023).

Note that other indirect costs may apply, such as customer loss or increased employee turnover.

Examples provided by Cooper and Davydenko (2007) show that the difference between \(\kappa ^{Dp}\) and the risk-free rate, \(\kappa ^F\), is 3%, whereas the risk premium (i.e., \(\kappa ^{D}-\kappa ^F\)) in \(\kappa ^{D}\) is only 1%.

Because \(\kappa ^{E\ell }= \dfrac{E+D-VETS+VEBC}{E}\kappa ^{Eu} +\dfrac{VETS}{E}\kappa ^{TS} -\dfrac{VEBC}{E}\kappa ^{BC} -\dfrac{D}{E}\kappa ^{Dp}\).

These notations were originally introduced in the manuscript of this study in 2022, which had not yet been published in a journal at that time. Later, Kim-Duc and Nam (2023) used these notations, crediting the source of these notations as this study, which was still in the form of a working paper.

See Kim-Duc and Nam (2023) for a discussion of the \(\Upsilon ^{TS}_t\) and \(\Upsilon ^{BC}_t\) formulae.

The discount rate at which to discount TS is still a controversial issue (see Graham 2003). For example, Miles and Ezzell (1985) argue that TSs have equity risk because debt is not fixed, and thus TS should be discounted at the return on assets, \(\kappa ^A\). If the D/E ratio is fixed in the first period, the discount rate is required to adjust, \(\kappa ^{TS}=\frac{1+\kappa ^A}{1+\kappa ^{D}}\) (Miles and Ezzell 1985).

Eq. (19) is identical to Eq. (18) when there is no PIT (i.e., \(\tau _{pd}=\tau _{pe}=0\)) or \(\tau _{pd}=\tau _{pe}\) (\(\ne 0\)). When \(\tau _{pd}>\tau _{pe}\), VETS under Miller (1977) is less than VETS under Modigliani and Miller (1963). This argument by Miller (1977) is strongly supported, because the facts typically show a lower \(\tau _{pe}\) relative to \(\tau _{pd}\). More importantly, in some situations, \(VETS \le 0\) if \(\tau _{pd}\) is large relative to \(\tau _{cs}\) and \(\tau _{pe}\) (Graham 2003).

\(\kappa ^{BC,e}\) in this section is equal to \(\kappa ^{BC}\) in previous sections. We add \(^e\) so that the notation of the discount rates in \(\widetilde{VEBC}\) are consistent with that in \(\widetilde{VETS}\).

Because \(\widetilde{\kappa }^{E\ell }= \dfrac{E+D-\widetilde{VETS}^e+\widetilde{VETS}^d+\widetilde{VEBC}}{E}\widetilde{\kappa }^{Eu} +\dfrac{\widetilde{VETS}^e}{E}\widetilde{\kappa }^{TS,e} -\dfrac{\widetilde{VETS}^d}{E}\widetilde{\kappa }^{TS,d} -\dfrac{\widetilde{VEBC}}{E}\widetilde{\kappa }^{BC,e} -\dfrac{D}{E}\widetilde{\kappa }^{Dp}\).

Similarly, these notations were originally introduced in the manuscript of this study in 2022, which had not yet been published in a journal at that time. Subsequently, Kim-Duc and Nam (2023) used these notations, crediting the source of these notations as this study, which was still in the form of a working paper.

Because of the same growth rate of earning in the first and stable period (i.e., \(g^E=4.5\%\)), Eq. (31) can be rewritten as \(V^{A\ell }_0=\underbrace{\frac{\widetilde{FCFF}_1}{\widetilde{\kappa }^{Eu}-g}}_{\widetilde{V}^{Au}_0} +\underbrace{\left[ \frac{D_0}{\widetilde{\kappa }^{TS,e}}+\widetilde{\Upsilon }^{TS,e}_0\right] \widetilde{\Phi }^{TS,e} -\left[ \frac{D_0}{\widetilde{\kappa }^{TS,d}}+\widetilde{\Upsilon }^{TS,d}_0\right] \widetilde{\Phi }^{TS,d}}_{\widetilde{VETS}_0} -\underbrace{\left[ \frac{D_0}{\widetilde{\kappa }^{BC,e}}+\widetilde{\Upsilon }^{BC,e}_0\right] \widetilde{\Phi }^{BC,e}}_{\widetilde{VEBC}_0}\). Hence, Eq. (32) becomes \(V^{A\ell }_0=\frac{1,607}{11.7\%-4.5\%} +\left[ \frac{4,000}{9\%}+117,384\right] 2.24\% -\left[ \frac{4,000}{8.5\%}+135,886\right] 1.20\% -\left[ \frac{4000}{8.1\%}+154,691\right] 0.03\% =\$23,686.\)

Because \(\widetilde{\kappa }^{E\ell }= \dfrac{E+D-\widetilde{VETS}^e+\widetilde{VETS}^d+\widetilde{VEBC}^e-\widetilde{VEBC}^d}{E}\widetilde{\kappa }^{Eu} +\dfrac{\widetilde{VETS}^e}{E}\widetilde{\kappa }^{TS,e} -\dfrac{\widetilde{VETS}^d}{E}\widetilde{\kappa }^{TS,d} -\dfrac{\widetilde{VEBC}^e}{E}\widetilde{\kappa }^{BC,e} +\dfrac{\widetilde{VEBC}^d}{E}\widetilde{\kappa }^{BC,d} -\dfrac{D}{E}\widetilde{\kappa }^D\).

References

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589

Altman EI, Hotchkiss E (2006) Corporate financial distress and bankruptcy: predict and avoid bankruptcy, analyze and invest in distressed debt. John Wiley and Sons, Inc., Hoboken, New Jersey, third edit edition

Altman EI, Iwanicz-Drozdowska M, Laitinen EK, Suvas A (2017) Financial distress prediction in an international context: a review and empirical analysis of Altman’s Z-score model. J Int Financ Manag Acc 28(2):131–171

Arnold S, Lahmann A, Schwetzler B (2018) Discontinuous financing based on market values and the value of tax shields. Bus Res 11(1):149–171

Arzac ER, Glosten LR (2005) A reconsideration of tax shield valuation. Eur Financ Manag 11(4):453–461

Bade B (2009) Comment on “The weighted average cost of capital is not quite right’’. Q Rev Econ Finance 49(4):1476–1480

Booth L (2007) Capital cash flows, APV and valuation. Eur Financ Manag 13(1):29–48

Branch B (2002) The costs of bankruptcy. Int Rev Financ Anal 11(1):39–57

Brealey R, Myers S (2003) Principles of Corporate Finance. NY, McGraw-Hill, New York

Brealey RA, Myers SC, Allen F (2014) Principles of Corporate Finance. McGraw-Hill/Irwin, 11st edition

Buchenroth SA, Pilotte EA (2004) An introduction to valuation with corporate and personal taxes: a teaching note. J Fin Educ 30:56–72

Cooper I, Nyborg K (2006) The value of tax shields IS equal to the present value of tax shields. J Financ Econ 81(1):215–225

Cooper IA, Davydenko SA (2007) Estimating the cost of risky debt. J Appl Corp Financ 19(3):90–95

Cooper IA, Nyborg KG (2007) Valuing the debt tax shield. J Appl Corp Financ 19(2):50–59

Cooper IA, Nyborg KG (2008) Tax-adjusted discount rates with investor taxes and risky debt. Financ Manage 37(2):365–379

Cooper IA, Nyborg KG (2018) Consistent valuation of project finance and LBOs using the flows-to-equity method. Eur Financ Manag 24(1):34–52

Damodaran A (2012) Investment valuation: tools and techniques for determining the value of any asset. John Wiley and Sons, Inc., 3rd edition

Dempsey M (2013) Consistent cash flow valuation with tax-deductible debt: a clarification. Eur Financ Manag 19(4):830–836

Dempsey M (2019) Discounting methods and personal taxes. Eur Financ Manag 25(2):310–324

Fernandez P (2004) The value of tax shields is NOT equal to the present value of tax shields. J Financ Econ 73(1):145–165

Fernandez P (2005) Reply to “Comment on the value of tax shields is NOT equal to the present value of tax shields’’. Q Rev Econ Finance 45(1):188–192

Fieten P, Kruschwitz L, Laitenberger J, Löffler A, Tham J, Vélez-Pareja I, Wonder N (2005) Comment on “The value of tax shields is NOT equal to the present value of tax shields’’. Q Rev Econ Finance 45(1):184–187

Graham JR (2003) Taxes and Corporate Finance: A Review. Review of Financial Studies 16(4):1075–1129

Husmann S, Kruschwitz L, Löffler A (2006) WACC and a generalized tax code. The Eur J Finance 12(1):33–40

IVSC (2021) International Valuation Standards 2021. International Valuation Standards Council, United Kingdom

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3(4):305–360

Keef SP, Khaled MS, Roush ML (2012) A note resolving the debate on “The weighted average cost of capital is not quite right’’. Q Rev Econ Finance 52(4):438–442

Kim-Duc N, Nam PK (2023) Inflation-related tax distortions in business valuation models: a clarification. The North Am J Econ Finance 66:101907

Kolari J (2018) Gross and net tax shield valuation. Manag Financ 44(7):854–864

Koller T, Goedhart M, Wessels D (2015) Valuation: measuring and managing the value of companies. McKinsey and Company, The United States of America, 6th, unive edition

Koziol C (2014) A simple correction of the WACC discount rate for default risk and bankruptcy costs. Rev Quant Financ Acc 42(4):653–666

Kraus A, Litzenberger RH (1973) A state-preference model of optimal financial leverage. J Financ 28(4):911–922

Krause MV, Lahmann A (2016) Reconsidering the appropriate discount rate for tax shield valuation. J Bus Econ 86(5):477–512

Kruschwitz L, Löffler A (2006) Discounted cash flow: a theory of the valuation of firms. John Wiley and Sons

Lin L, Flannery MJ (2013) Do personal taxes affect capital structure? Evidence from the 2003 tax cut. J Financ Econ 109(2):549–565

Lintner J (1965) The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Rev Econ Stat 47(1):13

Lorenz D, Kruschwitz L, Löffler A (2016) Are costs of capital necessarily constant over time and across states of nature? Q Rev Econ Finance 60:81–85

Luehrman TA (1997) Using APV (adjusted present value): a better tool for valuing operations. Harvard Bus Rev 75(3):2–10

Markowitz H (1952) Portfolio selection Harry Markowitz. J Financ 7(1):77–91

Massari M, Roncaglio F, Zanetti L (2008) On the Equivalence between the APV and the wacc Approach in a Growing Leveraged Firm. Eur Fin Manag, pp 152–162

Miles JA, Ezzell JR (1980) The weighted average cost of capital, perfect capital markets, and project life: a clarification. The J Fin Quant Anal 15(3):719

Miles JA, Ezzell JR (1985) Reformulating tax shield valuation: a note. J Financ 40(5):1485–1492

Miller MH (1977) Debt and taxes. J Financ 32(2):261–275

Miller RA (2009) The weighted average cost of capital is not quite right. Q Rev Econ Finance 49(1):128–138

Miller RA (2009) The weighted average cost of capital is not quite right: reply to M. Pierru. The Quart Rev Econ Fin 49(3):1213–1218

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297

Modigliani F, Miller MH (1963) Corporate income taxes and the cost of capital: a correction. Am Econ Rev 53(3):433–443

Molnár P, Nyborg KG (2013) Tax-adjusted discount rates: a general formula under constant leverage ratios. Eur Financ Manag 19(3):419–428

Myers SC (1974) Interactions of corporate financing and investment decisions-implications for capital budgeting. J Financ 29(1):1–25

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5(2):147–175

Myers SC (1984) The capital structure puzzle. J Financ 39(3):574–592

Pierru A (2009) “The weighted average cost of capital is not quite right’’: a comment. Q Rev Econ Finance 49(3):1219–1223

Pierru A (2009) “The weighted average cost of capital is not quite right’’: a rejoinder. Q Rev Econ Finance 49(4):1481–1484

Pinto JE, Henry E, Robinson TR, Stowe JD (2015) Equity Asset Valuation. John Wiley and Sons, Inc., Canada, 3rd edition

PwC (2017) Closing the value gap: valuation methodology survey 2016/2017. Technical report

RICS (2018) RICS professional standards and guidance, UK: risk, liability and insurance in valuation work. Technical report, United Kingdom

RICS (2019) RICS Valuation - Global Standards. United Kingdom: Royal Institution of Chartered Surveyors (RICS)

RICS (2021) RICS Valuation - Global Standards. United Kingdom: Royal Institution of Chartered Surveyors (RICS)

Ross G (2006) An Introduction to Corporate Finance-Transactions and Techniques. John Wiley & Sons

Ross S, Westerfield R, Jaffe J (2013) Corporate Finance. The McGraw-Hill Companies, Inc., New York, 10th edition

Sabal J (2007) WACC or APV? J Bus Valuat Econ Loss Anal 2(2):1–15

Schueler A (2018) Do We Need to Change the Way We Value Companies with the Flows-to-Equity Method? Comments on Cooper, IA, & Nyborg, KG (2018) Consistent Valuation of Project Finance and Lbos Using the Flows-to-Equity Method. European Financial Management 24:34–52

Schultze W (2004) Valuation, tax shields and the cost-of-capital with personal taxes: a framework for incorporating taxes. Int J Theor Appl Finance 07(06):769–804

Scott JH (1976) A theory of optimal capital structure. The Bell J Econ 7(1):33

Sharpe WF (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J Financ 19(3):425–442

Sick GA (1990) Tax-adjusted discount rates. Manage Sci 36(12):1432–1450

Taggart RA (1991) Consistent valuation and cost of capital expressions with corporate and personal taxes. Financ Manage 20(3):8

Warner JB (1977) Bankruptcy costs: some evidence. J Financ 32(2):337

Weiss LA (1990) Bankruptcy resolution. J Financ Econ 27(2):285–314

Acknowledgements

We sincerely thank anonymous reviewers for many constructive comments and suggestions, which significantly enhance our paper’s exposition. We also thank the conference participants at the \(38^{th}\) EBES Conference - Warsaw hosted in Poland in 2022 for the helpful comments provided. This research is funded by the University of Economics Ho Chi Minh City (UEH), Vietnam.

Funding

This research is funded by the University of Economics Ho Chi Minh City (UEH), Vietnam.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

“We cannot get there from here, OR we can get anywhere from anywhere....”

Appendices

Appendix A: Summary of notation

Symbol | Description |

|---|---|

\(V^{A\ell }\) | Intrinsic value of the levered firm |

\(V^{Au}\) | Intrinsic value of the unlevered firm |

CIT | Corporate income tax |

PIT | Personal income tax |

CoC | Cost of capital |

APV | Adjusted present value |

EBIT | Earnings before interest and taxes |

FCFF | Free cash flow to the firm |

TS | Tax savings from tax deductions of expected interest payments |

BC | Bankruptcy costs |

VETS | Present value of expected tax shields |

VEBC | Present value of expected bankruptcy costs |

E | Value of the firm’s (levered) equity |

D | Value of the firm’s debt |

\(\triangle\) | Change |

\(\tau _{cs}\) | Statutory corporate income tax rate |

\(\tau _{pd}\) | Personal tax rate on debt (interest) income |

\(\tau _{pe}\) | Personal tax rate on equity income (i.e., a blended dividend and capital gains tax rate) |

\(\kappa ^A\) | Expected rate (or cost) of capital (i.e., weighted average cost of capital, WACC) |

\(\kappa ^{E\ell }\) | Expected rate (or cost) of levered equity (i.e., cost of equity of the levered firm) |

\(\kappa ^{Eu}\) | Expected rate (or cost) of unlevered equity (i.e., cost of equity of the unlevered firm) |

\(\kappa ^{D}\) | Expected rate (or cost) of debt |

\(\kappa ^{Dp}\) | Promised yield on the debt |

\(\kappa ^{TS}\) | Expected rate (or cost) of tax shield component |

\(\kappa ^{TS,e}\) | Discount rate to discount tax shields from the point of view of equity holders |

\(\kappa ^{TS,d}\) | Discount rate to discount tax shields from the point of view of debt holders |

\(\kappa ^{BC}\) | Discount rate to discount bankruptcy costs |

\(\rho\) | Risk probability of default |

\(\phi\) | Indirect bankruptcy costs (the excess promised yield) |

\(\psi\) | Ratio of direct bankruptcy costs in year t to debt value in year \(t-1\) |

\(\Upsilon ^{TS}\) | Present value of \(\triangle D\) in the future in a world without PIT, discounted at \(\kappa ^{TS}\) |

\(\Upsilon ^{BC}\) | Present value of \(\triangle D\) in the future in a world without PIT, discounted at \(\kappa ^{BC}\) |

\(\Phi ^{TS}\) | Percentage of tax shields (at time t) to debt (at time \(t-1\)), i.e., \(\Phi ^{TS}=\kappa ^{Dp}\tau _{cs}\) |

\(\Phi ^{BC}\) | Percentage of bankruptcy costs (at time t) to debt (at time \(t-1\)), i.e., \(\Phi ^{BC}=\rho \phi +\rho \psi\) |

\(\hbar ^{(.),D}\) | Total discount factor for a company under a fixed level of debt in perpetuity [(.) includes TS and BC] |

\(\hbar ^{(.),\Upsilon }\) | Total discount factor for the change in debt in the future [(.) includes TS and BC] |

\(\hbar ^{(.)}\) | Total discount factor for (.) (i.e., TS and BC); \(\hbar ^{(.)}=\hbar ^{(.),D}+\hbar ^{(.),\Upsilon }\) |

\(\widetilde{(.)}\) | Notations (.) in the presence of PIT |

\(\widetilde{\tau }\) | Equivalent tax rate that properly accounts for integration between CIT and PIT |

\(\widetilde{TS}^e\) | Gross tax shields available to levered shareholders |

\(\widetilde{TS}^d\) | PIT paid by debt holders |

\(\widetilde{\kappa }^{TS,e}\) | After-PIT \(\kappa ^{TS}\) from the equity holders’ perspective [i.e., \(\widetilde{\kappa }^{TS,e}=\kappa ^{TS}(1-\tau _{pe})\)] |

\(\widetilde{\kappa }^{TS,d}\) | After-PIT \(\kappa ^{TS}\) from the debt holders’ perspective [i.e., \(\widetilde{\kappa }^{TS,d}=\kappa ^{TS}(1-\tau _{pd})\)] |

\(\widetilde{\kappa }^{BC,e}\) | After-PIT \(\kappa ^{BC}\) from the equity holders’ perspective [i.e., \(\widetilde{\kappa }^{BC,e}=\kappa ^{BC}(1-\tau _{pe})\)] |

\(\widetilde{\Upsilon }^{TS,e}\) | Present value of \(\triangle D\) in the future in a world with PIT, discounted at \(\widetilde{\kappa }^{TS,e}\) |

\(\widetilde{\Upsilon }^{TS,d}\) | Present value of \(\triangle D\) in the future in a world with PIT, discounted at \(\widetilde{\kappa }^{TS,d}\) |

\(\widetilde{\Upsilon }^{BC,e}\) | Present value of \(\triangle D\) in the future in a world with PIT, discounted at \(\widetilde{\kappa }^{BC,e}\) |

\(\widetilde{\Phi }^{TS,e}\) | Percentage of tax shields after PIT (at time t) to debt (at time \(t-1\)) from the point of view of equity holders, i.e., \(\widetilde{\Phi }^{TS,e}=\kappa ^{Dp}\left[ \tau _{cs}(1-\tau _{pe})+\tau _{pe}\right]\) |

\(\widetilde{\Phi }^{TS,d}\) | Percentage of tax shields after PIT (at time t) to debt (at time \(t-1\)) from the point of view of debt holders, i.e., \(\widetilde{\Phi }^{TS,d}=\kappa ^{Dp}\tau _{pd}\) |

\(\widetilde{\Phi }^{BC,e}\) | Percentage of bankruptcy costs (at time t) to debt (at time \(t-1\)), i.e., \(\widetilde{\Phi }^{BC,e}=(\rho \phi +\rho \psi )(1-\tau _{pe})\) |

\(\widetilde{\hbar }^{(.),D}\) | Total discount factor for a company under a fixed level of debt in perpetuity with PIT [(.) includes \(TS^e\), \(TS^d\), and BC] |

\(\widetilde{\hbar }^{(.),\Upsilon }\) | The total discount factor for the change in debt in the future with PIT [(.) includes \(TS^e\), \(TS^d\), and BC] |

\(\widetilde{\hbar }^{(.)}\) | Total discount factor for \(\widetilde{(.)}\) for a company in which the level of debt may change over time according to a fixed schedule, but it considers the CIT-PIT integration; \(\widetilde{\hbar }^{(.)}=\widetilde{\hbar }^{(.),D}+\widetilde{\hbar }^{(.),\Upsilon }\) |

Appendix B: VEBC with PIT on interest income

Appendix B demonstrates that the indirect costs of bankruptcy should not differentiate between gross and net excess rates of the promised yield, and should not employ two types of discount rates like the idea of \(\widetilde{VETS}\). In doing this, we begin by considering the CIT-PIT trade-off for the excess promised yield (i.e., \(\phi\)), similarly to the analysis of \(\widetilde{VETS}\). In this situation, the indirect costs of bankruptcy at time t can be rewritten as

Following the idea that \(\widetilde{TS}\) includes \(\widetilde{TS}^e\) and \(\widetilde{TS}^d\), we divide \(\widetilde{BC}^{[I]}\) into two components, namely, the indirect costs of bankruptcy from the point of view of equity, \(\widetilde{BC}^{[I],e}\), and that from the point of view of debt, \(\widetilde{BC}^{[I],d}\). We define \(\kappa ^{BC,e}\) and \(\kappa ^{BC,d}\) as the discount rates to discount bankruptcy costs from these two viewpoints. Equation (22) in the main text becomes

We introduce some additional notations:

-

\({\widetilde{\Upsilon }}^{BC,d}_t\) denotes the present value of the change of debt in the future period in a world with PIT, discounted at \(\widetilde{\kappa }^{BC,d}\), that is, \({\widetilde{\Upsilon }}^{BC,d}_t =\sum \limits _{i=2}^\infty \frac{\sum \limits _{j=t+1}^{t+i-1}\triangle D_j}{\left( 1+\widetilde{\kappa }^{BC,d}\right) ^i}\);

-

\(\widetilde{\Phi }^{BC,e}\) denotes the percentage of bankruptcy costs (at time t) to debt (at time \(t-1\)) from the point of view of equity holders, that is, \(\widetilde{\Phi }^{BC,e}=\rho \phi \left[ \tau _{cs}(1-\tau _{pe})+\tau _{pe}\right] +\rho \psi (1-\tau _{pe})\);

-

\(\widetilde{\Phi }^{BC,d}\) denotes the percentage of bankruptcy costs (at time t) to debt (at time \(t-1\)) from the point of view of debt holders, that is, \(\widetilde{\Phi }^{BC,d}=\rho \phi \tau _{pd}\).

Equation (25) can be rewritten as

We have \(E=[\widetilde{V}^{Au}+\widetilde{VETS}^e-\widetilde{VETS}^d-\widetilde{VEBC}^e+\widetilde{VEBC}^d-D]\) by combining the equation \(V^{A\ell }=D+E\) of the CoC method and Eq. (3) of the APV method. Equation (23) in the main text becomesFootnote 39

To this end, we define

Equation (29) in the main text becomes

In terms of the CIT-PIT trade-off, the difference between \(\widetilde{\Phi }^{TS,e}\) and \(\widetilde{\Phi }^{TS,d}\) reflects the trade-off for tax benefits, whereas the difference between \(\widetilde{\Phi }^{BC,e}\) and \(\widetilde{\Phi }^{BC,d}\) shows that for bankruptcy costs. The CoC-APV equivalence is still appropriate, because \(\widetilde{\Phi }^{TS,e}\) (or \(\widetilde{\Phi }^{BC,e}\)) can be larger than or smaller than or equal to \(\widetilde{\Phi }^{TS,d}\) (or \(\widetilde{\Phi }^{BC,d}\)).

For the TS-BC trade-off, the difference between \(\widetilde{\Phi }^{TS,e}\) and \(\widetilde{\Phi }^{BC,e}\) captures the trade-off from the point of view of equity in a world with PIT, whereas the difference between \(\widetilde{\Phi }^{TS,d}\) and \(\widetilde{\Phi }^{BC,d}\) implies that from the viewpoint of debt holders. When distinguishing between gross and net \(\widetilde{VEBC}^{[I]}\) (i.e., the excess rates of the promised yield), the CoC-APV equivalence differs from that in sect. 5 in two ways. First, there is a new component in the equivalent formulae, \(\widetilde{\Phi }^{BC,d}\), reflecting the excess rates of the promised yield from the debt holders’ viewpoint. The second is the difference in the formula of \(\widetilde{\Phi }^{BC,e}\), that is, \(\rho \phi \left[ \tau _{cs}(1-\tau _{pe})+\tau _{pe}\right] +\rho \psi (1-\tau _{pe})\), in this situation, rather than \((\rho \phi +\rho \psi )(1-\tau _{pe})\) in sect. 5.

Most importantly, two issues cause the mismatch in perspective from the TS-BC trade-off. First, \(\widetilde{\Phi }^{TS,d}\) (i.e., \(\kappa ^{Dp}\tau _{pd}\)) is always larger than \(\widetilde{\Phi }^{BC,d}\) (i.e., \(\rho \phi \tau _{pd}\)), because \(\kappa ^{Dp}\) is often larger than \(\phi\), and \(\rho\) is always less than one. Hence, \(\widetilde{\Phi }^{TS,d}-\widetilde{\Phi }^{BC,d}\) is unable to reflect the trade-off between tax benefits and indirect bankruptcy costs from the viewpoint of debt holders. This leads to the second issue that \(\widetilde{\Phi }^{TS,e}\) is always larger than \(\widetilde{\Phi }^{BC,e}\) if \(\widetilde{\Phi }^{BC,e}\) considers only indirect bankruptcy costs. In other words, in this situation, \(\widetilde{\Phi }^{TS,e}-\widetilde{\Phi }^{BC,e}\) captures only the TS-BC trade-off if and only if direct costs of financial distress are present. These confusions imply that \(\widetilde{VEBC}\), in general, and \(\widetilde{VEBC}^{[I]}\), in particular, should only follow the viewpoint of equity in the presence of PIT.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kim-Duc, N., Nam, P.K. Consistent valuation: extensions from bankruptcy costs and tax integration with time-varying debt. Rev Quant Finan Acc 62, 719–754 (2024). https://doi.org/10.1007/s11156-023-01217-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-023-01217-5