Abstract

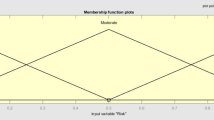

Trading a financial market involves the use of several tools that serve different purposes necessary to understand the behaviour of that particular market. One of the tools a trader must use is a method that determines the lot size of a trade, i.e., how many units are going to be bought or sold for a trade. Frequently, traders will use their experience and subjective deduction capabilities to determine the lot size, or simple mathematical formulas based on how much profit or loss they have realized during a particular period of time. This work proposes using a fuzzy inference system to determine the lot size, which uses input variables that any trading strategy should have access to (which means that any existing strategy can implement the proposed method). The experiments in this work compare basic trading strategies based on simple moving averages, one with a fixed lot size for every trade performed, and another one which uses the fuzzy inference system to establish a dynamic lot size. The results show that the dynamic lot size using the fuzzy inference system can help a trading strategy perform better.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

N.J. Balsara, Money Management Strategies for Futures Traders, vol. 4 (Wiley, 1992)

B.A. McDowell, A Trader’s Money Management System: How to Ensure Profit and Avoid the Risk of Ruin, vol. 406 (Wiley, 2010)

L.-Y. Wei, C.-H. Cheng, H.-H. Wu, A hybrid ANFIS based on n-period moving average model to forecast TAIEX stock. Appl. Soft Comput. 19 (2014)

A. Elder, Trading for a Living: Psychology, Trading Tactics, Money Management, vol. 31 (Wiley, 1993)

H. Till, Case Studies and Risk Management in Commodity Derivatives Trading (EDHEC-Risk Institute, 2011)

R.P. Barbosa, O. Belo, Autonomous forex trading agents, in Industrial Conference on Data Mining (Springer, Berlin, 2008)

S. Basak, D. Makarov, Strategic asset allocation in money management. J. Finance 69(1) (2014)

K.C.C. Chan, F.K. Teong, Enhancing technical analysis in the Forex market using neural networks, in Proceedings of IEEE International Conference on Neural Networks, vol. 2 (IEEE, 1995)

C.W.J. Granger, P. Newbold, Forecasting Economic Time Series (Academic Press, 2014)

T. Odean, B.M. Barber, Just How Much Do Individual Investors Lose by Trading? Law and Economics Workshop (2007)

M. Harris, Profitability and Systematic Trading: A Quantitative Approach to Profitability, Risk, and Money Management, vol. 342 (Wiley, 2008)

R. Vince, The Mathematics of Money Management: Risk Analysis Techniques for Traders, vol. 18 (Wiley, 1992)

H.T. Nguyen, H.V.D. Pham, H. Nguyen, The profitability of the moving average strategy in the french stock market. J. Econ. Dev. 16(2) (2014)

N.H. Hung, Y. Zhaojun, Profitability of applying simple moving average trading rules for the Vietnamese stock market. J. Bus. Manag. 2(3) (2013)

L. Wang et al., Generating moving average trading rules on the oil futures market with genetic algorithms. Math. Probl. Eng. (2014)

Y. Leu, T.-I. Chiu, An effective stock portfolio trading strategy using genetic algorithms and weighted fuzzy time series, in 2011 15th North-East Asia Symposium on Nano, Information Technology and Reliability (NASNIT), IEEE (2011)

L. Yu, Lean, K.K. Lai, S. Wang, Designing a hybrid AI system as a forex trading decision support tool, in 17th IEEE International Conference on Tools with Artificial Intelligence (ICTAI’05), IEEE (2005)

H. Hakim, Forex Trading and Investment. Diss., Worcester Polytechnic Institute, 2012

C. Wagner, Juzzy-a java based toolkit for type-2 fuzzy logic, in 2013 IEEE Symposium on Advances in Type-2 Fuzzy Logic Systems (T2FUZZ), IEEE (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Hernandez-Aguila, A., Garcia-Valdez, M., Castillo, O. (2018). Money Management for a Foreign Exchange Trading Strategy Using a Fuzzy Inference System. In: Castillo, O., Melin, P., Kacprzyk, J. (eds) Fuzzy Logic Augmentation of Neural and Optimization Algorithms: Theoretical Aspects and Real Applications. Studies in Computational Intelligence, vol 749. Springer, Cham. https://doi.org/10.1007/978-3-319-71008-2_21

Download citation

DOI: https://doi.org/10.1007/978-3-319-71008-2_21

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-71007-5

Online ISBN: 978-3-319-71008-2

eBook Packages: EngineeringEngineering (R0)